Capital allowances for pubs and restaurants

Unlock tax benefits from your restaurant and pub assets!

Capital allowances on hospitality properties

Capital allowances are a form of tax relief restaurant and pub owners can claim on certain types of capital expenditure, such as fixtures and fittings and any assets they use in their business.

Unfortunately, capital allowances are widely underclaimed in the pub and restaurant industry, with around 80% of hospitality owners having never claimed at all! You don’t want to be paying more tax than you have to, so understanding your capital allowances is essential!

For owners of pubs and restaurants, capital allowances on fixtures and fittings provide tax relief on the reduction in value of certain embedded installations that were already on the property when it was purchased, as well as new items.

Items such as commercial kitchens, bars, lighting and toilers can all qualify for capital allowances.

Have the best capital allowances consultants on your side

At Eureka Capital allowances, we have over 20 years of experience in capital allowances, and help our clients to unlock thousands of pounds of hidden tax relief in their properties.

We don’t just help pub and restaurant owners, we also provide our knowledge and services to holiday and residential parks,B&Bs, offices, and doctors and dentist surgeries!

How to know if your pub, restaurant or bar qualifies for capital allowances

There are a number of different criteria your establishment needs to meet in order to qualify for capital allowances:

- Legal ownership: Your pub, restaurant, or bar must be owned by a legal entity (individual, partnership, or company).

- Active business operations: The business should be actively engaged in providing food, beverages, and hospitality services to customers.

- Qualifying assets: Your property must include qualifying assets such as kitchen equipment, bar fixtures and certain renovations or improvements that enhance the property’s functionality.

- Capital expenditure: You must have incurred capital expenditure on eligible assets. This includes costs related to purchasing, installing, or improving these assets.

- Generating taxable profits: Your business should generate taxable profits to benefit from claiming capital allowances.

Capital allowances services

Capital Allowances purchase claims are widely underclaimed in the hospitality industry, but a pub or restaurant claim is typically 25% of the purchase price! At Eureka, our team have unrivalled experience in providing our capital allowances services that can save restaurateurs thousands of pounds by identifying hidden tax relief that they’re unaware of.

Why choose Eureka?

As business owners know, running it takes up most of our time and finding time for other things can be difficult. Eureka did all the work, from start to finish, so we could focus on our business. We were never aware that as owners, you are allowed to claim tax relief on items that were already in the building when it was bought, and this is service accountants cannot provide. Eureka liaised with our accountant and obtained a fantastic result that will help us save money for years to come. We highly recommend!

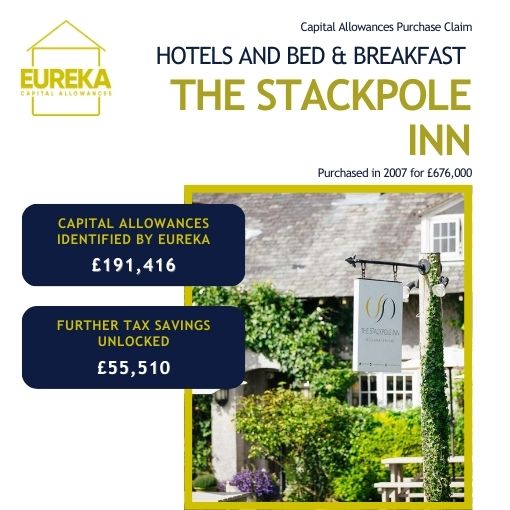

Gary and Becky. Owners, Stackpole Inn

What are capital allowances for hospitality establishments?

Capital allowances for hospitality owners are a form of tax relief that owners of pubs and restaurants can claim for certain types of capital expenditure, such as the purchase or improvement of commercial kitchens, bar infrastructure and fixtures and fittings. This allows owners to deduct a portion of the asset’s cost from their taxable profits, reducing their tax liability.

What types of assets in pubs and restaurants qualify for capital allowances?

In pubs and restaurants, capital allowances can be claimed on several types of assets, including:

- Water and heating systems

- Underground pipework

- Carpets

- Doors and locks

- Heating and ventilation

- Lighting systems

- Electrics

- Fire alarms and security systems

- Furniture, fixtures and fittings

How do I claim capital allowances for my business?

To claim capital allowances, you need to identify qualifying assets, calculate the capital expenditure incurred, and include this information in your tax return. Working with a capital allowances specialist like us here at Eureka Capital Allowances can streamline this process and ensure accuracy.

A capital allowances survey might be necessary to assess the value of assets such as plant and machinery, fixtures, and integral features. The allowances are then claimed over time as per the tax rules. It’s crucial to ensure that the seller has not already claimed allowances on these assets, as this could affect your eligibility.

Can I claim capital allowances if my business is making a loss?

If your pub, restaurant, or bar is operating at a loss, you may not be able to reap the benefits of capital allowances immediately. However, you can potentially carry forward the allowances to offset future taxable profits. Speak to us to learn more.

Questions?

Have any questions that we haven't answered here? Get in touch with us and we will do our best to answer them for you!

Contact usAbout us

We are team of Capital Allowances Consultants with over 20 years experience, helping commercial property owners unlock hidden tax relief in their property.

Learn more