Capital Allowances for

Furnished Holiday Lets Examples

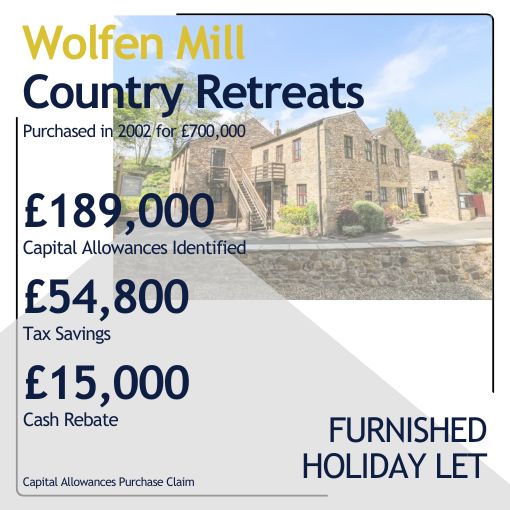

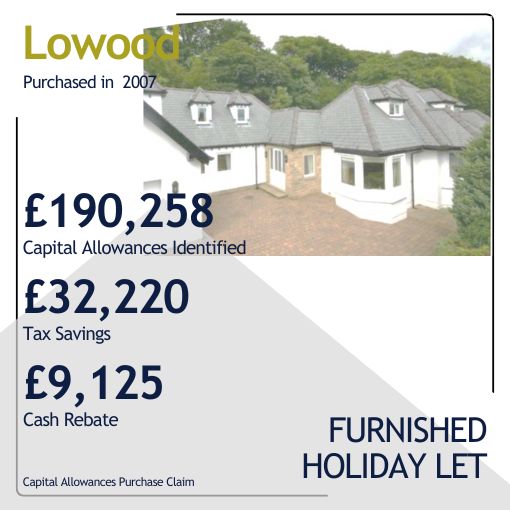

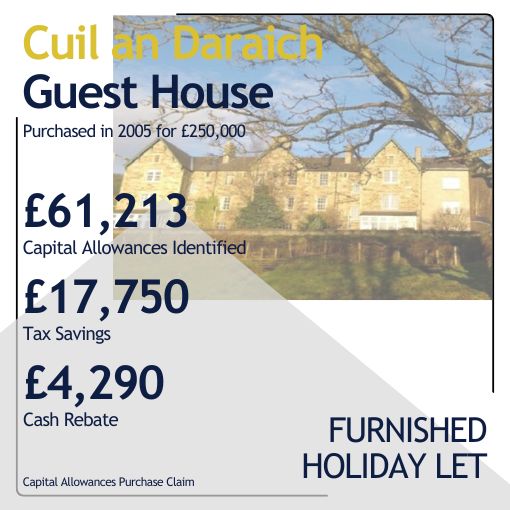

Capital Allowances purchase claims are widely underclaimed in the self-catering accommodation industry, with around 80% of retail owners having never claimed (source: HMRC).

Eureka help save Self-Catering Property Owners tens of thousands of pounds by identifying hidden tax relief on ‘embedded fixtures’ (not loose fixtures) that owners are unaware of and their accountants have not or cannot claim.

✓ Free Review, Success based fee

✓ Working with your Accountant

✓ We do all the heavy lifting

✓ Capital Allowances trained Surveyors

Please be aware: The FHL Tax Regime is being abolished in April 2025. You can still carry your allowances forward beyond this date and benefit from your tax savings, but only IF you claim them before this date. More information on these changes can be found on the government website.

Did you Know?

By using a specialist Capital Allowances firm, FHL owners can be helped to an average of £40,000 in tax savings per property

Did you know that you can claim on items know as 'embedded fixtures' (not loose fixtures) that were already in/on the property when it was purchased as well new items?

Heating Systems

Underground Pipework

Bathrooms & Kitchens

Ironmongery

Ventilation Systems

Water Systems

Electrical Systems

Fire Alarms Systems

… and much more.

Even if these items have been repaired or replaced,

we can still review, and claim in most cases.

Fiona Campbell

CEO of ASSC